philadelphia wage tax refund 2020

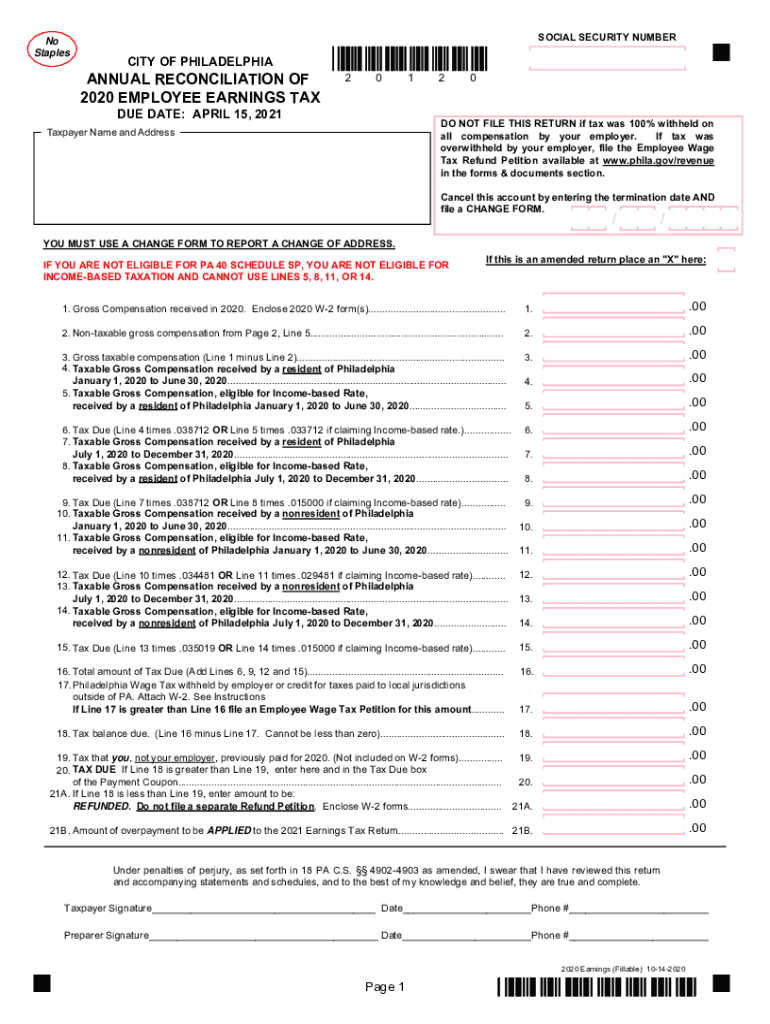

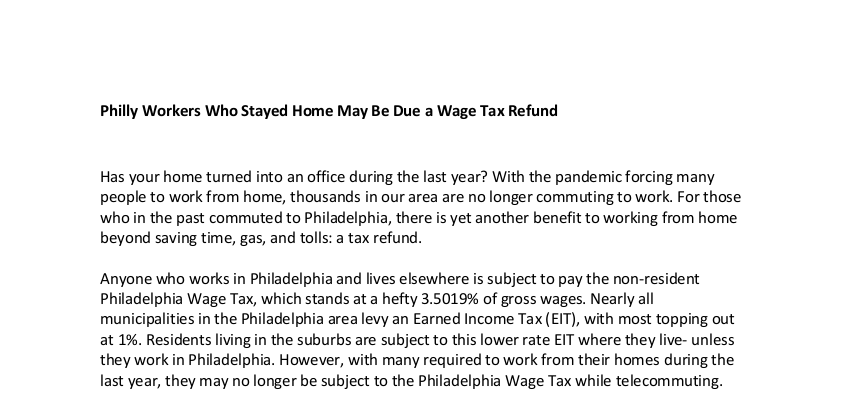

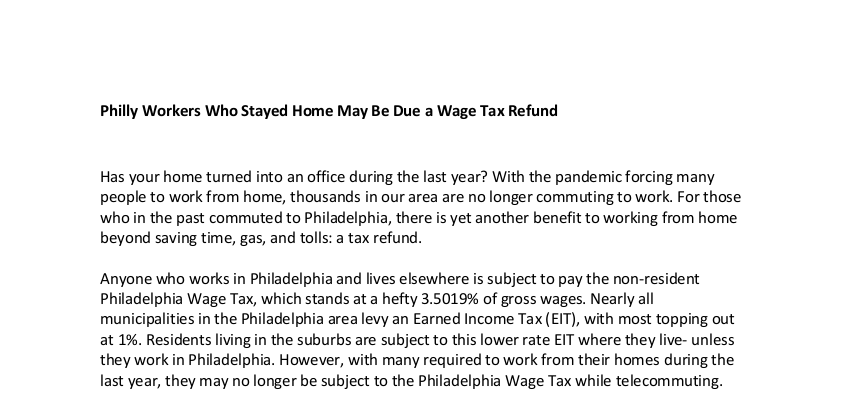

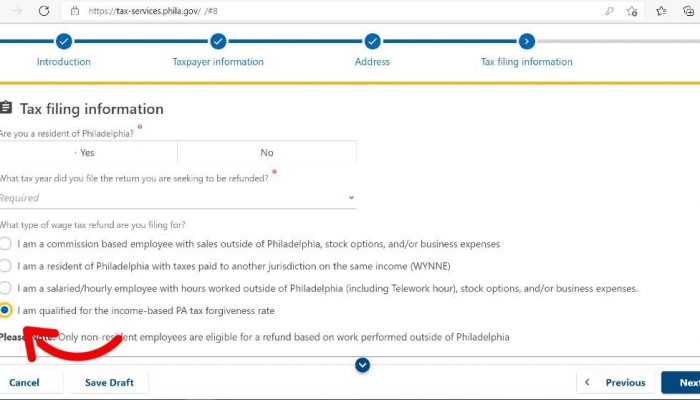

The department is staffing up she said in the departments All About Wage Tax Refunds video on YouTube. City residents have to pay 38712 and non-residents who work in the city owe 35019 2020 tax year.

Get Pa Annual Reconciliation Employee Earnings Tax City Of Philadelphia 2020 2022 Us Legal Forms

Please dont call us a week after you file for your refund she said.

. As of January 8 2021 the City of Philadelphia has not updated their portal with a Wage Tax Refund Petition Form for 2020. Philadelphia City Wage Tax 2020 -- claim NJ credit andor Phila refund. Wage tax refund in say June of 2021 for 2020 taxes withheld after I file my 2020 NJ taxes when I amend my 2020 NJ return could I still be subject to the same penalty and.

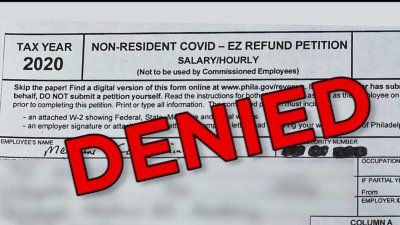

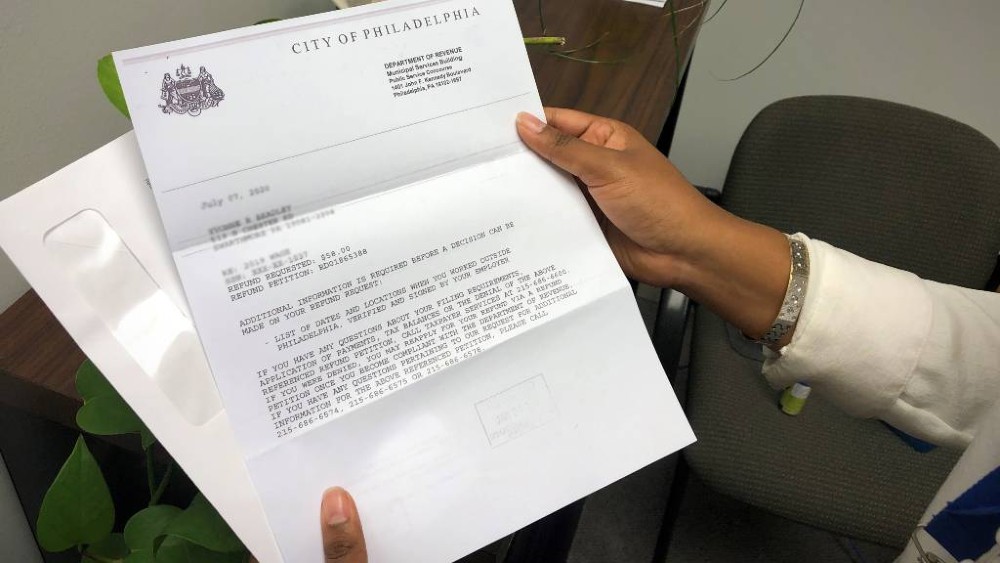

The City announced it expects to post the form during the first week of February on the Income-based Wage Tax refund petition webpage. The refund is allowable only for periods during which a non-resident employee was required to work outside of Philadelphia either pursuant to City ordinance or employer policy. Because the City of Philadelphia is expecting an extreme increase in the number of refund petitions for 2020 they have attempted to make the process easier.

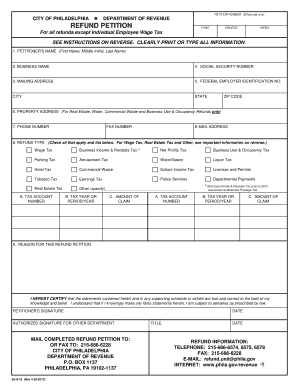

Philadelphia claimed on line 2D of the refund petition If you worked outside the city due to COVID-19 please mark COVID-19 in the location column of the dates and location template Employer Signature This signature verifies the location and days or hours reported to the City of Philadelphia on the. And finance officials estimate theyll refund a total of 105 million to nonresident commuters for 2020 by the time theyre done. So you might think non.

The Philadelphia Department of Revenue is providing 2020 City Wage Tax refunds to non-city residents required to work from home due to the pandemic. Its going to be awhile. Tax forms instructions.

Philadelphia employers are required to give an income-based wage tax refund petition to employees at the. Make an appointment for City taxes or a water bill in person. How to file and pay City taxes.

If youre interested in last years 2019. Claimants must include a copy of their W-2 along with a signed letter on employer. All Philadelphia residents owe the Wage Tax regardless of where they work.

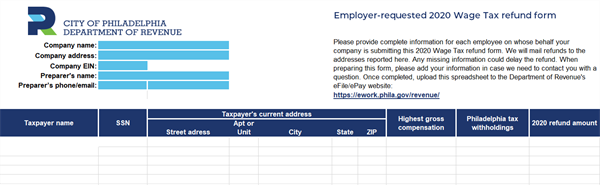

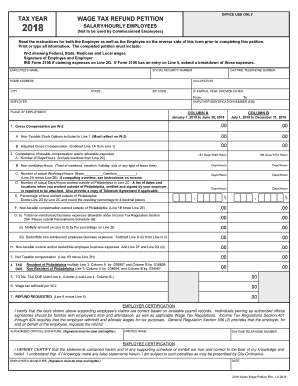

For 2020 refund petitions the Philadelphia Department of Revenue has created a special Wage Tax refund form that allows the University to submit refund requests on behalf of non-Philadelphia residents. Refunds only apply for days that employees were required to perform their work duties remotely outside of the city. July 1 2020 to December 31 2020 38712 038712 January 1 2020 to June 30 2020 34481 034481 July 1 2020 to December 31 2020 35019 035019 Statute of Limitations - any claim for refund must be filed within three 3 years from the date the tax was paid or due whichever date is later.

The Business Income and Receipts Tax was formerly known as the Business Privilege Tax BPT You are basically being taxed for the privilege of. Eligible nonresident employees may file a refund claim for the wage tax withheld while they worked from home as required by the employer during 2020. The deadline is weekly monthly semi-monthly or quarterly depending on the amount of Wage Tax you withhold.

Prior to 2020 to request a refund of wage taxes paid employees had to file and submit a Wage Tax Refund Petition to the city. The Philadelphia Department of Revenue is providing 2020 City Wage Tax refunds to non-city residents required to work from home due to the pandemic. Non-residents who work in Philadelphia must also pay the Wage Tax.

If I decide to apply for the Phila. Refunds only apply for days that employees were required to perform their work duties remotely outside of the city. Employees are not eligible.

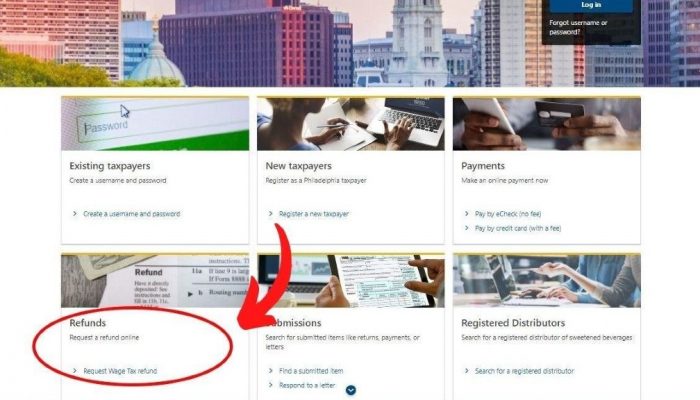

You can now also request any Wage Tax refund online. The City will refund Wage Tax that was withheld by the employer above the 15 discounted rate. Philadelphia has passed legislation for 2020 wage earners that allows them to seek a refund of overpaid wage taxes that were in excess of 15.

Interest penalties and fees. Those refunds are being issued as many suburbanites continue to work from home. For questions regarding city wage tax refund call 215-926-2245 or email tupaytaxtempleedu.

Hi ErnieSO I think I know the answer to this question but along these same lines. A taxpayer residents or non-resident with Pennsylvania Tax Forgiveness pays Wage Tax at a reduced 15 rate. If employees opted to work.

For 2020 refund petitions the Philadelphia Department of Revenue has created a special wage tax refund form that allows the University to submit refund requests on behalf of non-Philadelphia residents. The refund is allowable only for periods during which a non-resident employee was required to work outside of Philadelphia either pursuant to City ordinance or employer policy. As of mid-August Philadelphia had sent checks to about 32000 people according to city spokesperson Kevin Lessard.

These forms help taxpayers file 2020 Wage Tax. Heres the link. If employees opted to work remotely even if it was for childcare or.

Electronic funds transfer EFT Modernized e-Filing MeF for City taxes. Go back to HR Resources More in Taxes and Deductions. If youre approved for Tax Forgiveness under Pennsylvania 40 Schedule SP you may be eligible for an income-based Wage Tax refund.

Normally Philadelphia non-residents employed in the city can get a wage tax refund for days they worked outside of Philadelphia. This form could not be filed electronically. The employee wage tax refund claim form will be available the first week of February 2021 via the City of Philadelphias website.

You can also file and pay Wage Tax online. She predicted a six- to eight-week wait for a refund. Pay delinquent tax balances.

As the 2020 tax year rolls to an end this is what you need to know about Philadelphia tax rates due dates and a few tips to help you fill out your return and minimize the amount owed.

Philadelphia Wage Tax Refund Request Form For 2020 Wouch Maloney Cpas Business Advisors

Philadelphia Wage Tax Refund Opportunities Tax Year 2020 Baker Tilly

Philly Workers Who Stayed Home May Be Due A Wage Tax Refund Newtown Township Bucks County Pennsylvania

Who Is Entitled To A Wage Tax Refund Department Of Revenue City Of Philadelphia

Philadelphia Refunds Millions In Wage Taxes To Suburban Commuters

Wage Tax Refund Petition 2020 Fill Online Printable Fillable Blank Pdffiller

Wage Tax Refund Petition 2020 Fill Online Printable Fillable Blank Pdffiller

Covid Makes Everything Difficult But Philly Makes Tax Refunds Easier

Philadelphia Wage Tax Refunds Delayed Due To 500 Increase In Applications Nbc10 Philadelphia

Success Wage Tax Refund R Philadelphia

Wage Tax Refunds And Payment Plans Made Easy Department Of Revenue City Of Philadelphia

Philadelphia Wage Tax Petition Fill Out And Sign Printable Pdf Template Signnow

Submit A Bulk Request For Philly Wage Tax Refunds Department Of Revenue City Of Philadelphia

Delayed City Wage Tax Refunds Still Being Paid Nbc10 Philadelphia

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of Philadelphia

City Of Philadelphia Wage Tax Refund Fill Out And Sign Printable Pdf Template Signnow

There S A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia